Your Sbi home loan interest rate reduction images are ready in this website. Sbi home loan interest rate reduction are a topic that is being searched for and liked by netizens today. You can Get the Sbi home loan interest rate reduction files here. Find and Download all royalty-free images.

If you’re looking for sbi home loan interest rate reduction pictures information related to the sbi home loan interest rate reduction topic, you have pay a visit to the right site. Our website always provides you with hints for seeing the maximum quality video and picture content, please kindly search and find more enlightening video articles and graphics that fit your interests.

Sbi Home Loan Interest Rate Reduction. Accordingly the limited period offer ends on March 31 2021 with home loan interest rates starting as low as 670 per cent for loans of up to Rs 75 lakh and 675 per cent for loans in the range of Rs 75 lakh to Rs 5 crore. State Bank of India the countrys largest lender on Monday reduced its interest rate on home loans up to 75 lakh to 670 per cent its lowest interest rate on home loans on record. A premium of 10 bps will be added to the Card Rate for customers falls under RG 4 to 6 05 bps concession will be available to women. Under Marginal Cost Lending Rate MCLR reduction in rate of interest is automatic.

Sbi Home Loan Interest Rates Descrition Of Sbi Home Loan Interest Rates From dialabank.com

Sbi Home Loan Interest Rates Descrition Of Sbi Home Loan Interest Rates From dialabank.com

State Bank of India the countrys largest lender on Monday reduced its interest rate on home loans up to 75 lakh to 670 per cent its lowest interest rate on home loans on record. A premium of 10 bps will be added to the Card Rate for customers falls under RG 4 to 6 05 bps concession will be available to women. Those above Rs 75 lakh will be charged interest at 705 per cent. With the reduction SBI home loan interest rates now start from 67 per cent for loans up to Rs 30 lakh and 695 per cent for loans between Rs 30 lakh and Rs 75 lakh. The benefit of the MCLR reduction will be passed on to. In April 2019 SBIs 1-year MCLR stood at 85 per cent.

A premium of 10 bps will be added to the Card Rate for Loan up to Rs 30 Lacs if LTV ratio is 80.

This is applicable for all loans sanctioned after April 2016. Under Marginal Cost Lending Rate MCLR reduction in rate of interest is automatic. Apart from this women borrowers will receive an additional special concession of 5 basis pointsAccording to C S Setty Managing Director for retail and digital banking customer affordability can increase to a great extent. The base rate is. With the reduction SBI home loan interest rates now start from 67 per cent for loans up to Rs 30 lakh and 695 per cent for loans between Rs 30 lakh and Rs 75 lakh. A premium of 10 bps will be added to the Card Rate for customers falls under RG 4 to 6 05 bps concession will be available to women.

The benefit of the MCLR reduction will be passed on to. The State Bank of India SBI has reduced lower range of home loan interest rate to 670 per cent from 695 per cent. The benefit of the MCLR reduction will be passed on to. This is applicable for all loans sanctioned after April 2016. How to reduce home loan interest.

Source: timesofindia.indiatimes.com

Source: timesofindia.indiatimes.com

SBI reduces interest rate on MCLR-linked loans. SBI reduces interest rate on MCLR-linked loans. Accordingly the limited period offer ends on March 31 2021 with home loan interest rates starting as low as 670 per cent for loans of up to Rs 75 lakh and 675 per cent for loans in the range of Rs 75 lakh to Rs 5 crore. The State Bank of India had stated that it had reduced the rate of interest on home loans to 67 from 695. Form Process benefitDownload form.

Lets see an example – if a borrower had availed a home loan from SBI on August 1 2019 the interest rate will remain unchanged till July 31 2020 despite any MCLR cut announced by the bank. In a move that would reduce the cost of borrowing Indias largest lender State Bank of India SBI in July 2020 reduced the interest on its home loans linked with the marginal cost of funds-based lending rates MCLR by 25 basis points to 7. If you have already taken the loan you can move ahead and refinance your loan at a very lower interest rate. SBI charges an average interest rate of around 940 per cent on base rate home loans. Borrowers whose home loans were sanctioned before April 2016 may switch over to the MCLR from base rate by paying one time upfront fee of.

Source: businesstoday.in

Source: businesstoday.in

Need a SBI Personal loan SBI Bumper Offer low interest rate on housing Loan Low EMI in SBI Good News For home buyers - Home Loan Interest rate 75 LIC Home Loan Interest rate reduced హమ లన వడడ రటల తగగచన ఎలఐస హసగ. To make a low-interest payout minimize the interest rate of your loan. SBI charges an average interest rate of around 940 per cent on base rate home loans. Those above Rs 75 lakh will be charged interest at 705 per cent. Lets see an example – if a borrower had availed a home loan from SBI on August 1 2019 the interest rate will remain unchanged till July 31 2020 despite any MCLR cut announced by the bank.

Source: housing.com

Source: housing.com

The benefit of the MCLR reduction will be passed on to. In April 2019 SBIs 1-year MCLR stood at 85 per cent. In a move that would reduce the cost of borrowing Indias largest lender State Bank of India SBI in July 2020 reduced the interest on its home loans linked with the marginal cost of funds-based lending rates MCLR by 25 basis points to 7. The base rate is. How to reduce home loan interest.

This is applicable for all loans sanctioned after April 2016. As interest rate is. Here are 7 essential tips to reduce home loan interest rate Go for a shorter tenure Prepayments are a good option too Compare interest rates online Home loan balance transfer can be an alternative Pay more as down payment Look for Better Deals Increase your EMI. The State Bank of India SBI has reduced lower range of home loan interest rate to 670 per cent from 695 per cent. The benefit of the MCLR reduction will be passed on to.

Source: ratingwalls.blogspot.com

Source: ratingwalls.blogspot.com

Earlier SBI had reduced home loan rate to 67 per cent till March 31 as part of a festive offer. Need a SBI Personal loan SBI Bumper Offer low interest rate on housing Loan Low EMI in SBI Good News For home buyers - Home Loan Interest rate 75 LIC Home Loan Interest rate reduced హమ లన వడడ రటల తగగచన ఎలఐస హసగ. Home loan interest rates reduced by the State Bank of India. Borrowers whose home loans were sanctioned before April 2016 may switch over to the MCLR from base rate by paying one time upfront fee of. The base rate is.

It came down to 74 per cent as in April 2020 falling below 8 per cent for the first time in 15 years. To make a low-interest payout minimize the interest rate of your loan. A premium of 15 bps will be added to the Card Rate for Non-Salaried Customers. The State Bank of India SBI has reduced lower range of home loan interest rate to 670 per cent from 695 per cent. Mumbai City Latest Updates.

Source: fundstiger.com

Source: fundstiger.com

Those above Rs 75 lakh will be charged interest at 705 per cent. Accordingly the limited period offer ends on March 31 2021 with home loan interest rates starting as low as 670 per cent for loans of up to Rs 75 lakh and 675 per cent for loans in the range of Rs 75 lakh to Rs 5 crore. To make a low-interest payout minimize the interest rate of your loan. Besides the lender has also given 100 per cent waiver on processing fees. State Bank of India the countrys largest lender on Monday reduced its interest rate on home loans up to 75 lakh to 670 per cent its lowest interest rate on home loans on record.

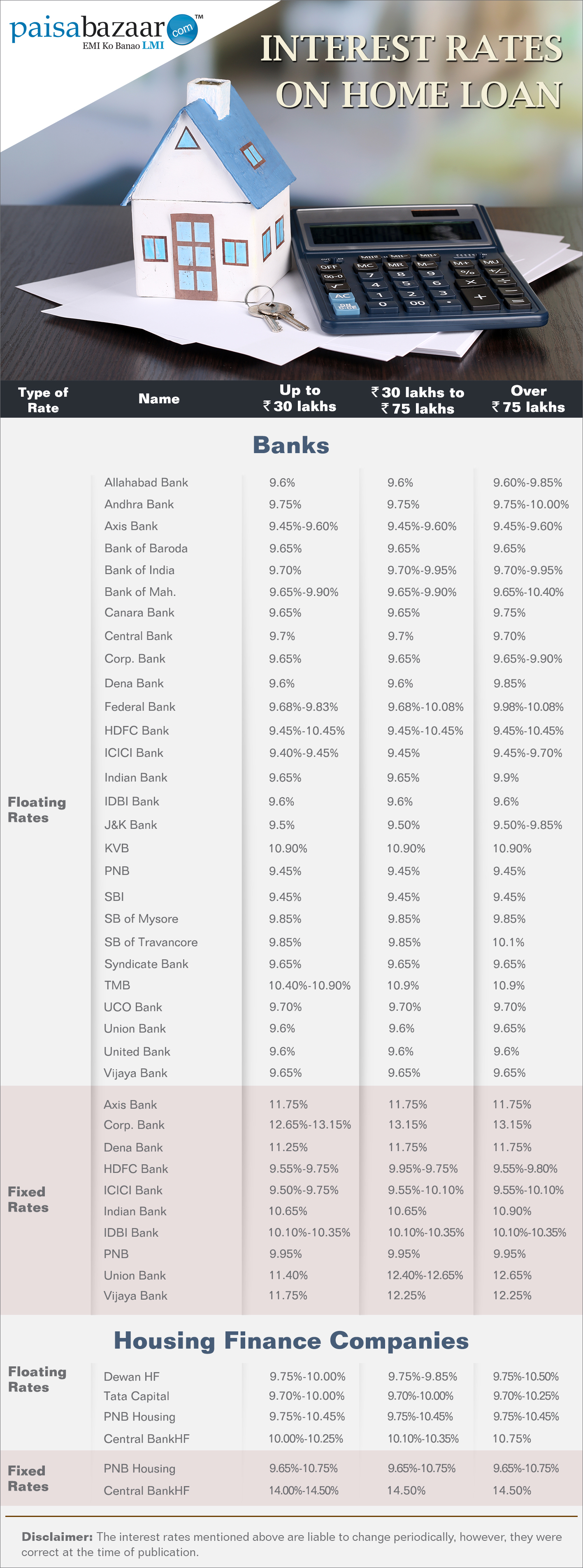

Source: paisabazaar.com

Source: paisabazaar.com

The benefit of the MCLR reduction will be passed on to. Mumbai City Latest Updates. Earlier SBI had reduced home loan rate to 67 per cent till March 31 as part of a festive offer. The State Bank of India had stated that it had reduced the rate of interest on home loans to 67 from 695. State Bank of India the countrys largest lender on Monday reduced its interest rate on home loans up to 75 lakh to 670 per cent its lowest interest rate on home loans on record.

The benefit of the MCLR reduction will be passed on to. To make a low-interest payout minimize the interest rate of your loan. Earlier SBI had reduced home loan rate to 67 per cent till March 31 as part of a festive offer. Mumbai City Latest Updates. Form Process benefitDownload form.

Source: twitter.com

Source: twitter.com

In April 2019 SBIs 1-year MCLR stood at 85 per cent. Lets see an example – if a borrower had availed a home loan from SBI on August 1 2019 the interest rate will remain unchanged till July 31 2020 despite any MCLR cut announced by the bank. To make a low-interest payout minimize the interest rate of your loan. The State Bank of India had stated that it had reduced the rate of interest on home loans to 67 from 695. This is applicable for all loans sanctioned after April 2016.

Source: myloancare.in

Source: myloancare.in

A premium of 10 bps will be added to the Card Rate for customers falls under RG 4 to 6 05 bps concession will be available to women. Besides the lender has also given 100 per cent waiver on processing fees. If you have already taken the loan you can move ahead and refinance your loan at a very lower interest rate. Under Marginal Cost Lending Rate MCLR reduction in rate of interest is automatic. In April 2019 SBIs 1-year MCLR stood at 85 per cent.

Source: kalingatv.com

Source: kalingatv.com

How to reduce home loan interest. Earlier SBI had reduced home loan rate to 67 per cent till March 31 as part of a festive offer. Since October 1 2019 the loans are. The base rate is. Under Marginal Cost Lending Rate MCLR reduction in rate of interest is automatic.

Source: lopol.org

Source: lopol.org

SBIs almost Rs 1 lakh crore home loan portfolio is locked in the old base rate regime. Since October 1 2019 the loans are. A premium of 10 bps will be added to the Card Rate for customers falls under RG 4 to 6 05 bps concession will be available to women. In April 2019 SBIs 1-year MCLR stood at 85 per cent. Lets see an example – if a borrower had availed a home loan from SBI on August 1 2019 the interest rate will remain unchanged till July 31 2020 despite any MCLR cut announced by the bank.

Source: livemint.com

Source: livemint.com

The State Bank of India had stated that it had reduced the rate of interest on home loans to 67 from 695. Home loan interest rates reduced by the State Bank of India. A premium of 15 bps will be added to the Card Rate for Non-Salaried Customers. Lets see an example – if a borrower had availed a home loan from SBI on August 1 2019 the interest rate will remain unchanged till July 31 2020 despite any MCLR cut announced by the bank. It came down to 74 per cent as in April 2020 falling below 8 per cent for the first time in 15 years.

Source: zeebiz.com

Source: zeebiz.com

Mumbai City Latest Updates. As a short loan tenure helps to complete the loan repayment faster which results in very low and affordable interest cost. The base rate is. Accordingly the limited period offer ends on March 31 2021 with home loan interest rates starting as low as 670 per cent for loans of up to Rs 75 lakh and 675 per cent for loans in the range of Rs 75 lakh to Rs 5 crore. Here are 7 essential tips to reduce home loan interest rate Go for a shorter tenure Prepayments are a good option too Compare interest rates online Home loan balance transfer can be an alternative Pay more as down payment Look for Better Deals Increase your EMI.

Source: ndtv.com

Source: ndtv.com

The benefit of the MCLR reduction will be passed on to. State Bank of India the countrys largest lender on Monday reduced its interest rate on home loans up to 75 lakh to 670 per cent its lowest interest rate on home loans on record. SBIs almost Rs 1 lakh crore home loan portfolio is locked in the old base rate regime. Apart from this women borrowers will receive an additional special concession of 5 basis pointsAccording to C S Setty Managing Director for retail and digital banking customer affordability can increase to a great extent. SBI reduces interest rate on MCLR-linked loans.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title sbi home loan interest rate reduction by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.